georgia film tax credit history

By the fiscal year 2015 the amount spent by Georgia in issued tax credits for the year was just over 504 million. GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project.

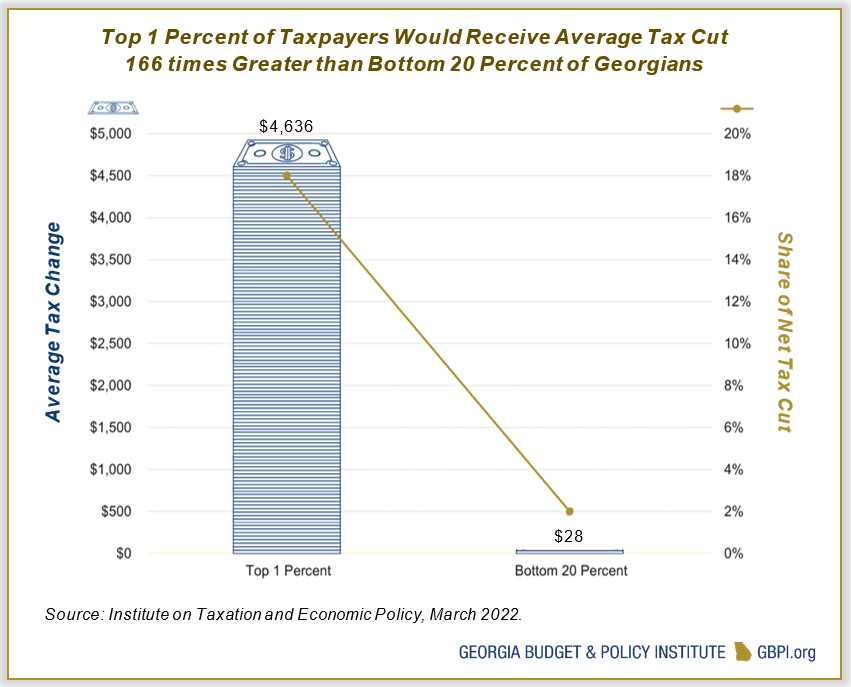

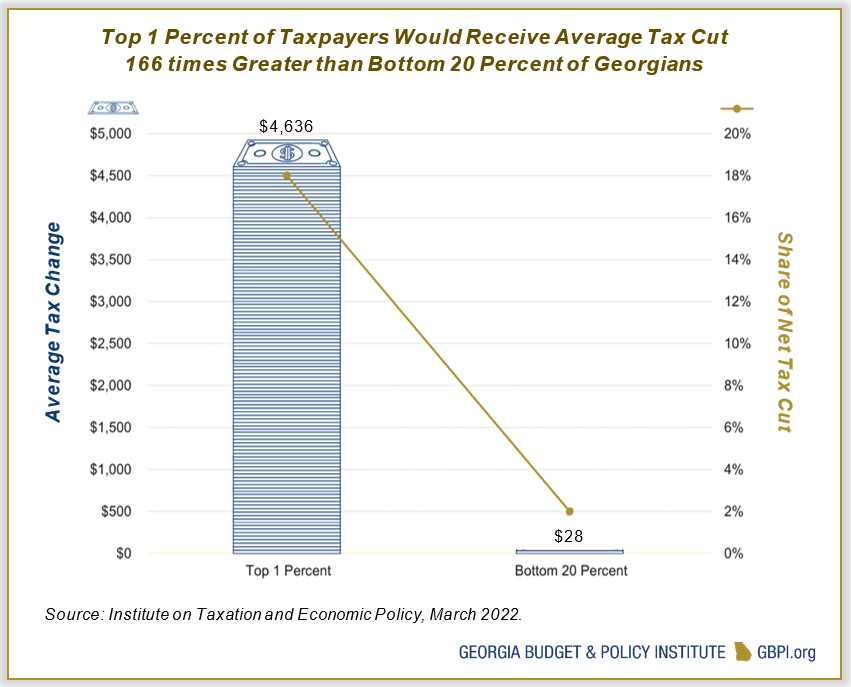

House Proposes Massive Tax Cuts For Wealthiest Slashing State Revenues Bill Analysis House Bill 1437 Lc 43 2318s Georgia Budget And Policy Institute

20 base transferable tax credit.

. A Base Certification Application may be submitted within 90 days of the start of principal photography. Georgia is a production-friendly state with transferable film tax credits up to 30 of qualified expenditures. In 2005 Georgia spent 103 million on its film incentive.

A Base Certification Application may be submitted within 90 days of the start of principal photography. On average 1 of Georgia Film Tax credit can be purchased for 087 to 090. Audits are required for Film Tax Credits based on the date the production was certified by the Department of Economic Development DECD and the amount of credit.

Rule 560-7-8-45 Film Tax Credit Georgia Department of Revenue. This can include a single production or the total of multiple projects aggregated in a single tax year. About the Film Tax Credit First passed in 2005 Georgias film tax credit provides an income tax credit to production companies that spend at least 500000 on qualified productions.

Free location scouting assistance is offered. In return Georgia realized only 65 million in net new revenue meaning the state self-inflicted a net revenue loss of 602 million. Georgias film tax credit is popular among those working in the film industry but it comes with a major cost according to the AJC report.

The tax credit had grown from 141 million in 2010 to an estimated 870 million in 2019. The figure is 40 higher than the states previous record. The bill was headed to a full vote in the State Senate when it.

The tax credit had grown from 141 million in 2010 to an estimated 870 million in 2019. The broadening of this legislation permits a Georgia corporate fiduciary or individual taxpayer to purchase these credits to offset their Georgia income tax liability. The base credit rate was raised to 20 in 2008 with an additional 10 for a qualified promotion of the state eg Georgia logo.

GEORGIA FILM TAX CREDIT For a project to be eligible for the 20 base transferable tax credit the Georgia Department of Economic Development must certify the project. With 33 billion invested in 2013 alone it is clear that the Georgia film business is booming now more than ever. One section included placing a cap on the Georgia film tax credit at 900 million.

Georgias film tax credit is popular among those working in the film industry but it comes with a considerable cost according to the AJC report. That amount increased to 1406 million by 2010. However companies received film tax credits they did not qualify auditors claim.

Georgia doled out a record 12 billion in film and TV tax credits last year far surpassing the incentives offered by any other state. The Georgia Entertainment Industry Investment Act GEIIA gives a 20 tax credit to companies that spend 500000 or more in Georgia during production and post-production. The big finding is that Georgias film incentive returned only 10 cents per dollar of tax credit given.

GA Film Tax Credit - List of Expenditures final 12-14-18pdf 3015 KB. Of the film tax credit 18-03A was released earlier this month. An additional 10 credit is given for placing a Georgia logo in your film title or credits.

Film Tax Credit - Revised December 20 2021 Georgia Department of Revenue. Certification for live action projects will be through the Georgia Film Office. In 2016 Georgia granted 667 million in tax credits for film productions.

Productions that qualify receive a 20 tax credit. Companies received film tax credits they did not qualify auditors claim. List of Film Tax Credit Expenditures.

All productions with credit more than 250000000. Some Georgia film tax incentives include. Certification for live action projects will be through the Georgia Film Office.

Mbs Equipment Company Unveils New Georgia Headquarters At Trilith Studios Below The Line Below The Line

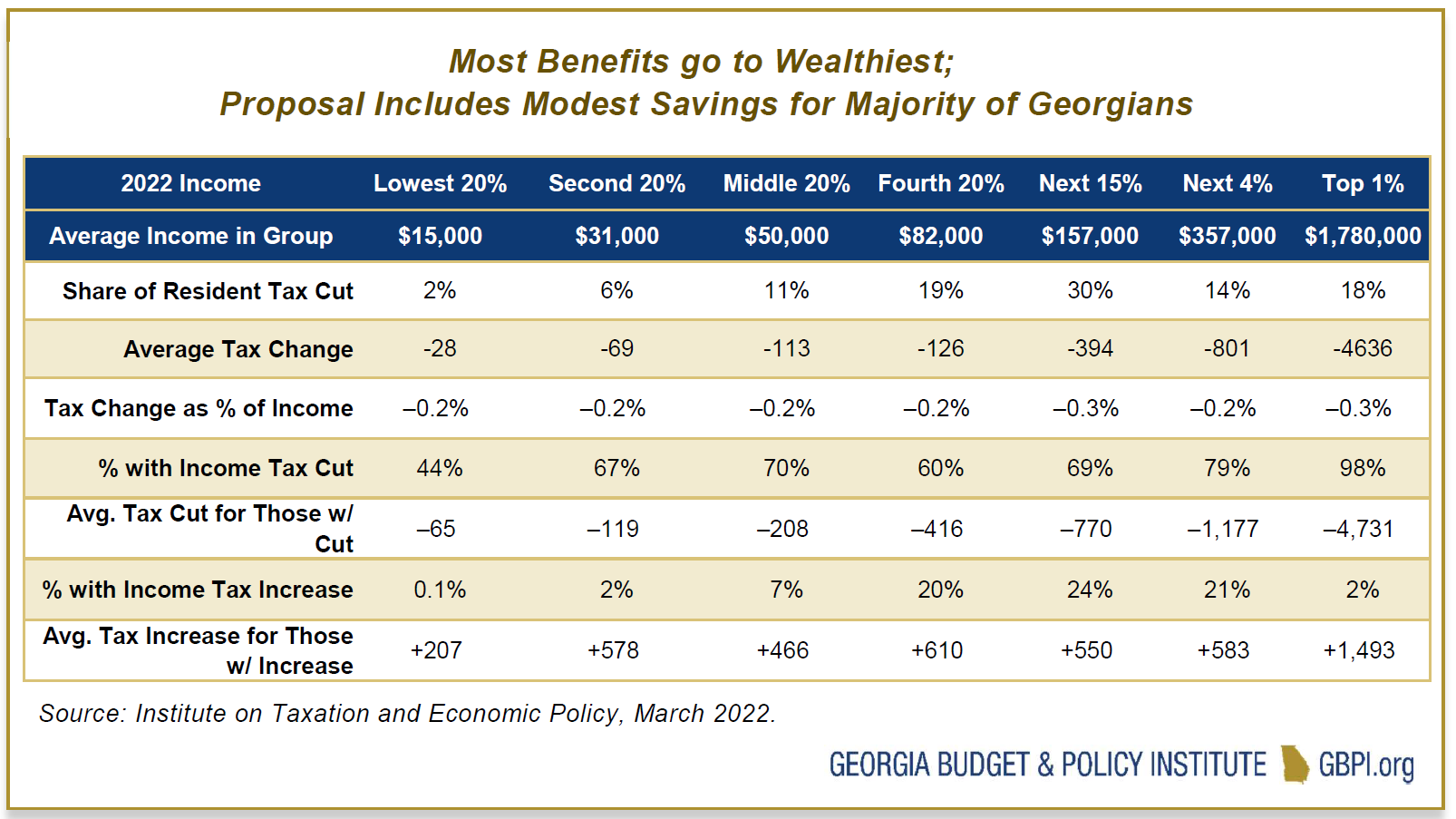

Updates On Georgia State Tax Credits What You Need To Know Mauldin Jenkins

Directors Stop Looming Over Your Dp S Shoulder And Do Something Useful Different Personality Types Shoulder Something To Do

Updates On Georgia State Tax Credits What You Need To Know Mauldin Jenkins

House Proposes Massive Tax Cuts For Wealthiest Slashing State Revenues Bill Analysis House Bill 1437 Lc 43 2318s Georgia Budget And Policy Institute

Follow Three Ring Studios S Threeringstudio Latest Tweets Twitter

Updates On Georgia State Tax Credits What You Need To Know Mauldin Jenkins

Celebrating The Economic Impact Of Productions In Georgia

Fictional Characters Make Experiential Crossings Into Real Life Study Finds Hearing Voices The Voice Real Life